Inflation Steady at 2.8%: Business Strategies for Profit Margins

Inflation Holds Steady at 2.8%: Strategies for US Businesses to Maintain Profit Margins requires proactive measures, including cost optimization, strategic pricing, diversification, technology adoption, and strong customer relationships, to navigate economic pressures and sustain profitability in the US market.

As US businesses navigate the complexities of a fluctuating economy, understanding how to maintain profit margins amidst steady inflation holds steady at 2.8%: strategies for US businesses to maintain profit margins is crucial. What steps can companies take to thrive in this environment?

Understanding the US Inflation Landscape

Understanding the current inflation rate is key to planning for the future. In the US, inflation has held steady at 2.8%, a rate that requires businesses to adopt strategic financial approaches.

This stable yet persistent level of inflation affects various sectors and business operations, demanding careful assessment and proactive solutions to preserve profitability.

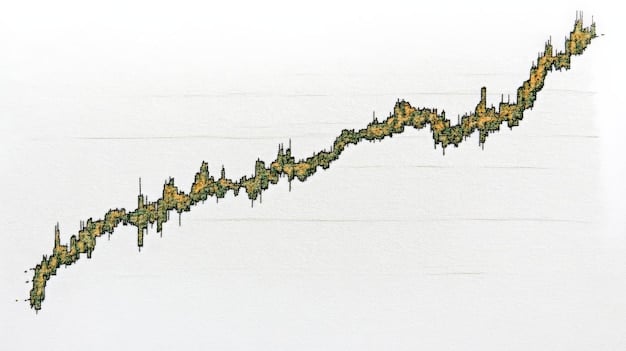

Historical Inflation Trends in the US

Examining historical data provides context for today’s economic pressures. Over the past decade, inflation rates have fluctuated, influenced by factors like economic growth, monetary policy, and global events. Understanding these patterns helps businesses anticipate future trends.

The Current Inflation Rate: Key Indicators

The current 2.8% inflation rate is supported by several key indicators. These include the Consumer Price Index (CPI), the Producer Price Index (PPI), and employment figures. Monitoring these indicators allows firms to make informed decisions and adjust their financial strategies accordingly.

- CPI tracks the average change in prices consumers pay for goods and services.

- PPI measures the change in prices received by domestic producers.

- Employment figures offer insight into labor market conditions and wage pressures.

In conclusion, a deep understanding of the current inflation landscape is essential for companies aiming to maintain profitability. By monitoring key indicators and examining historical trends, businesses can make informed decisions that mitigate the impact of inflation.

Cost Optimization Strategies for Businesses

One effective way to combat the effects of inflation is through rigorous cost optimization. By identifying areas where costs can be reduced without compromising quality, businesses can improve their bottom line.

Cost optimization involves streamlining operations, reducing waste, and negotiating better deals with suppliers. These measures allow companies to maintain profitability amid inflationary pressures.

Streamlining Operations and Reducing Waste

Operational efficiency is crucial for cost reduction. Companies should focus on streamlining processes, eliminating redundancies, and reducing waste. This involves a thorough review of workflows to identify areas for improvement.

Negotiating with Suppliers for Better Deals

Better pricing can be achieved by negotiating favorable terms with suppliers. Building strong relationships and exploring alternative vendors can lead to reduced costs and improved profitability.

- Consolidate purchases to increase bargaining power.

- Seek long-term contracts with guaranteed prices.

- Explore alternative suppliers that offer competitive rates.

Strategic cost optimization enables businesses to not only survive but also thrive during periods of inflation. By streamlining operations, reducing waste, and securing better deals with suppliers, companies can maintain their profit margins.

Strategic Pricing Adjustments

Adjusting prices strategically is vital during periods of sustained inflation. Price adjustments must be carefully balanced to maintain competitiveness while covering increased costs.

Effective pricing strategies ensure that profit margins are preserved without deterring customers. This may involve a combination of cost-plus pricing, value-based pricing, and competitive pricing.

Cost-Plus Pricing vs. Value-Based Pricing

The choice between cost-plus and value-based pricing depends on market conditions and customer expectations. Cost-plus pricing involves adding a fixed percentage to the cost of goods, while value-based pricing focuses on the perceived value to the customer.

Competitive Pricing Analysis

Understanding how competitors are pricing their products is essential. Conducting a competitive analysis helps businesses to identify opportunities for differentiation and adjust their prices accordingly. This ensures that businesses remain competitive while maintaining profit margins.

- Monitor competitor pricing strategies regularly.

- Identify unique value propositions to justify premium pricing.

- Offer promotions and discounts strategically to attract price-sensitive customers.

Strategic pricing adjustments are essential for businesses navigating inflation. By balancing cost-plus and value-based pricing, and conducting competitive analyses, companies can maintain profitability while remaining competitive in their markets.

Diversification of Revenue Streams

Diversification can help US businesses mitigate risks associated with inflation. By entering new markets or offering new products, companies can stabilize their revenues and reduce their dependence on any single stream of income.

Diversifying revenue streams can provide a buffer against the adverse effects of inflation, improving financial resilience and long-term stability.

Entering New Markets

Expanding into new geographic or demographic markets can open up fresh revenue opportunities. Market research and careful planning are vital when entering new markets, ensuring a good fit with the company’s capabilities and reducing risk.

Developing New Products and Services

Introducing new products and services can attract new customer segments and increase overall revenue. Innovation and market relevance are key to successful product diversification. This helps businesses to expand their customer base and capture new opportunities.

- Conduct market research to identify unmet customer needs.

- Invest in research and development to innovate new offerings.

- Test and refine new products based on customer feedback.

Revenue diversification provides a robust defense against inflation-induced volatility. By entering new markets and developing new products businesses can build resilience and secure sustainable growth.

Adopting Technology to Enhance Efficiency

Technology plays a pivotal role in efficiency and productivity. Companies can realize significant cost savings and enhanced output by investing in automation, data analytics, and cloud computing.

By adopting technology, businesses can streamline operations, optimize resource allocation, and stay competitive in an inflationary environment.

Automation and AI

Automation and AI can streamline repetitive tasks, reducing labor costs, and improving accuracy. This includes deploying robotic process automation (RPA) and AI-driven inventory management systems.

Data Analytics for Informed Decisions

Data analytics provides insights that facilitate better decision-making. Companies can leverage data to identify inefficiencies, predict market trends, and optimize pricing strategies. This enables businesses to respond quickly to changing conditions and maintain a competitive edge.

- Implement data analytics tools to track key performance indicators.

- Use predictive analytics to forecast market trends and customer behavior.

- Optimize pricing and inventory based on data insights.

Investing in technology can transform business operations. The adoption of automation, AI, and data analytics improves efficiency and competitiveness. These strategies contribute to enhanced resilience amid persistent inflationary pressures.

Building Strong Customer Relationships

Maintaining customer loyalty is crucial, particularly in an inflationary environment. Companies should focus on building strong relationships through personalized experiences, excellent service, and proactive communication.

Customer loyalty leads to repeat business and positive word-of-mouth, providing a stable foundation for growth, even during periods of rising prices.

Personalized Customer Experiences

Personalizing the customer experience can enhance satisfaction and foster loyalty. This involves tailoring products, services, and communications to meet individual customer needs. Personalized experiences deepen customer connections and increase retention.

Loyalty Programs and Rewards

Loyalty programs and rewards incentivize repeat purchases. These programs reward customers for their continued business, fostering brand loyalty and creating a sense of value. This motivates customers to remain engaged and loyal, even when prices rise.

- Implement personalized communication strategies.

- Offer targeted promotions and discounts to valued customers.

- Develop customer loyalty programs that reward repeat business.

Building strong customer relationships leads to enduring loyalty. By focusing on personalization, excellent service, and meaningful rewards, companies can retain customers and secure stable revenue, even in the face of economic challenges.

| Key Area | Brief Description |

|---|---|

| 💰 Cost Optimization | Reduce waste and negotiate better supplier deals. |

| 📈 Pricing Strategy | Balance cost-plus and value-based approaches. |

| 🌱 Diversification | Enter new markets and develop new products. |

| 🤝 Customer Loyalty | Personalize experiences and reward customer loyalty. |

Frequently Asked Questions

▼

Inflation increases the cost of raw materials, labor, and operational expenses, squeezing profit margins. This often leads to higher prices for consumers, potentially reducing demand.

▼

Quick actions include renegotiating supplier contracts, reducing discretionary spending, and implementing energy-efficient practices to lower utility costs in the short term.

▼

Technology can automate processes, enhance efficiency, and provide data-driven insights to optimize pricing and inventory management, which helps cut costs and improve decision-making.

▼

Retaining existing customers is more cost-effective than acquiring new ones. Loyal customers are more likely to accept price increases if they perceive continued value in your offerings.

▼

Transparent communication with customers about value and price adjustments builds trust and understanding, helping to maintain customer loyalty, thus supporting healthy profit margins.

Conclusion

In conclusion, businesses in the US can navigate the challenges posed by a steady inflation rate of 2.8% by taking proactive and strategic measures. By focusing on cost optimization, strategic pricing adjustments, diversification, technology adoption, and customer relationships, businesses can maintain profit margins and achieve sustainable growth.