US Business Leaders’ Insights on Proposed Corporate Tax Changes

US Business Leaders React to the Proposed Corporate Tax Changes: A Comprehensive Analysis reveals a spectrum of opinions, ranging from concerns about competitiveness to cautious optimism regarding potential economic stimulus.

The potential overhaul of corporate tax policies in the United States has ignited considerable debate within the business community. US Business Leaders React to the Proposed Corporate Tax Changes: A Comprehensive Analysis is crucial for understanding the possible economic implications and strategic responses of major companies.

Understanding Proposed Corporate Tax Changes

Proposed corporate tax changes in the US aim to reshape the fiscal landscape for businesses, impacting profitability, investment strategies, and overall economic competitiveness. These potential reforms have triggered diverse reactions from business leaders across various sectors.

Examining the core components of the proposed changes is crucial. These may include adjustments to the corporate tax rate, modifications to deductions and credits, and shifts in international taxation rules.

Key Components of the Tax Reform

The tax proposals may touch several aspects of corporate taxation. Key components often debated include:

- Tax Rate Adjustments: Changes to the headline corporate tax rate are frequently a focal point, impacting overall profitability.

- Deductions and Credits: Modifications to existing deductions and tax credits can significantly affect specific industries.

- International Taxation: Revisions to international tax rules can influence multinational corporations’ strategies.

Understanding these key components is essential for assessing the potential impact on businesses.

In conclusion, the proposed corporate tax changes are multifaceted and can affect various segments of the business community. Analyzing the details of these proposals is essential for informed decision-making.

Initial Reactions from Major Corporations

Immediately following the announcement of proposed corporate tax changes, reactions from major corporations varied significantly. Leaders expressed concerns, hopes, and a general call for clarity.

Some acknowledged potential benefits, while others emphasized the uncertainties and possible drawbacks. This section presents a snapshot of these early responses and insights.

Positive Outlooks on Potential Economic Stimulus

Some business leaders voiced optimism, focusing on the potential for tax cuts to stimulate economic growth. Arguments typically revolved around:

- Increased Investment: Lower tax rates may encourage companies to invest more in innovation and expansion.

- Job Creation: Stimulus can lead to an increase in job opportunities as businesses grow.

- Enhanced Competitiveness: Lower corporate taxes might make US businesses more competitive globally.

Such views often highlight the long-term potential for economic benefits arising from tax reforms.

Concerns About Competitiveness and Investment

Conversely, other leaders cautioned against the potential negative impacts on competitiveness. Concerns often included:

- Global Competitiveness: Some worried that the changes might make the US less attractive for foreign investment.

- Debt Implications: Concerns were raised about the long-term impact of tax cuts on national debt.

- Uneven Distribution of Benefits: Some critics suggested that the benefits of tax cuts might not be evenly distributed across all sectors.

These concerns underscore the need for careful consideration of all possible implications.

In summary, initial reactions from major corporations reflected a mix of optimism and concern. The long-term impact will depend on how these reforms are implemented and how businesses adapt.

Industry-Specific Responses to Tax Reforms

Different industries often react differently to tax reforms depending on their specific circumstances and unique tax sensitivities. This section examines some industry-specific perspectives on the proposed corporate tax changes.

Understanding these nuances is vital to grasp the full scope of the implications and strategize accordingly.

Technology Sector

The technology sector, known for its innovation, often has specific concerns related to research and development incentives. Many discussions in this sector include:

- R&D Credits: Changes to R&D credits would significantly impact investments in new technologies.

- Intellectual Property: Taxation of intellectual property is a crucial consideration for tech companies.

- International Revenue: International tax rules greatly influence the strategies of multinational tech firms.

These unique factors drive the tech sector’s specific responses.

Manufacturing Sector

For the manufacturing sector, issues like capital investment incentives and the taxation of domestic production are important. Key considerations include:

- Capital Investment: Tax incentives for capital investment would encourage companies to modernize equipment.

- Domestic Production: Initiatives supporting domestic production can enhance manufacturing competitiveness.

- Supply Chain Resilience: Tax measures that encourage supply chain resilience are becoming increasingly important.

As such, the manufacturing sector’s perspectives are often centered on these issues.

In short, analyzing industry-specific responses to tax reforms provides valuable insights. Each sector weighs its own set of challenges, and this approach is crucial to understanding the wider implications.

Potential Impacts on Small and Medium-Sized Businesses

Small and medium-sized businesses (SMBs) may experience different challenges and opportunities resulting from corporate tax changes compared to their larger counterparts. This section explores the potential impacts specifically on SMBs.

These businesses often operate with leaner margins and less financial flexibility, making them particularly sensitive to tax reforms.

Challenges for SMBs

Smaller businesses may encounter hurdles that larger companies are better equipped to navigate:

- Compliance Costs: Smaller firms may find it more challenging to manage compliance costs.

- Access to Expertise: Lack of in-house tax expertise may put SMBs at a disadvantage.

- Capital Constraints: Limited access to capital can restrict investment in growth opportunities.

Understanding these issues is crucial to developing appropriate support strategies.

Opportunities for Growth

Despite challenges, the tax reforms also present opportunities for SMBs, like:

- Simplified Tax Code: Simpler tax rules can reduce compliance complexity.

- Cash Flow Improvements: Tax cuts may improve cash flow for smaller businesses.

- Increased Investment: Improved conditions can lead to higher levels of investment and job growth.

Optimizing strategies accordingly can help SMBs seize these opportunities for growth.

In conclusion, the potential impacts of corporate tax changes on SMBs are complex. Recognizing both the challenges and opportunities allows for better adaptation and development.

Analyzing Long-Term Economic Effects

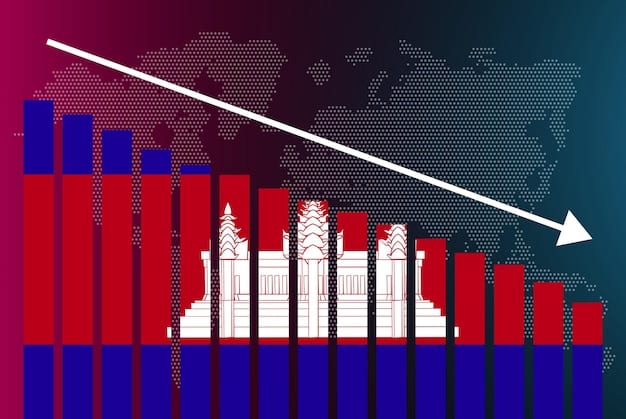

Assessing the long-term economic effects of proposed corporate tax changes requires a comprehensive analysis of their potential ripple effects throughout the economy. These effects can impact economic growth, income distribution, and fiscal stability.

Understanding these long-term implications is essential for policy-making and strategic business planning.

Impact on Economic Growth

Tax reforms can significantly influence the pace and sustainability of economic growth. Whether the reforms lead to accelerated growth or economic stagnation often depend on several elements:

Fiscal stimulus can foster short-term expansion. However, the sustainability of this growth hinges on whether it prompts long-term productivity gains.

- Investment Incentives: Tax incentives can stimulate business investment and innovation.

- Productivity Gains: Tax reforms can foster long-term productivity and profitability enhancements.

Balancing short-term stimulus with long-term sustainability is vital.

Effects on Income Distribution

Changes to corporate taxes can impact income distribution in a multitude of ways, affecting different segments of society uniquely.

Some argue that corporate tax cuts disproportionately benefit shareholders and high-income earners. Others contend that they create economic opportunities that lift all income levels by improving labor market conditions and wages.

In this regard, economic models and empirical studies can help assess the distributional impacts, informing policy discussions about fairness and equity.

In conclusion, analyzing the long-term economic effects requires a detailed understanding of both economic growth and income distribution. Tax changes can have broad implications that affect society at large.

Future Strategies for Business Adaptation

Given the uncertainty surrounding future tax policies, businesses must adopt flexible strategies to adapt effectively. This involves careful planning, continuous monitoring, and a proactive approach to policy changes.

Strategic adaptation is key to navigating the ever-changing landscape and optimizing business performance.

Planning for Uncertainty

One of the most important strategies for businesses to adopt is robust scenario planning. Such planning ensures that they are prepared for a multitude of eventualities.

- Scenario Analysis: Organizations should create alternative scenarios reflecting different tax policy outcomes.

- Strategic Flexibility: Businesses should maintain the agility to adjust their operational strategies as needed.

This approach allows businesses to maintain a high level of preparedness and responsiveness.

Monitoring and Advocacy

Staying engaged with policy developments is critical as well. Businesses can take steps such as:

- Policy Monitoring: Stay informed about the latest updates regarding tax regulations.

- Advocacy and Engagement: Participate in discussions about corporate taxation.

Such engagement ensures that business interests are taken into consideration during policy decisions.

To summarize, future strategies for business adaptation should emphasize planning, flexibility, and a proactive approach. With these measures, businesses can enhance resilience and competitive advantage.

| Key Point | Brief Description |

|---|---|

| 📊 Tax Rate Impact | Changes in corporate tax rates affect profitability and investment decisions. |

| 💼 SMB Adaptation | Small businesses need strategies for tax compliance and growth opportunities. |

| 🌐 Global Competitiveness | Tax policies influence the competitiveness of US businesses internationally. |

| 🌱 Economic Effects | Long-term impacts on growth, income distribution, and fiscal stability matter. |

Frequently Asked Questions

▼

The primary objectives often include stimulating economic growth, enhancing global competitiveness, and simplifying tax compliance for businesses operating within the United States.

▼

Lower rates can free up capital, allowing small businesses to invest in expansion, hire more employees, and enhance operational efficiency through new technology adoption.

▼

Capital-intensive sectors like manufacturing, technology, and energy typically stand to gain substantially due to increased investment incentives and improved cash flow management.

▼

Possible drawbacks include increased national debt, potential exacerbation of income inequality, and the risk of reduced investment in public goods and services.

▼

Smart strategies involve robust scenario planning, maintaining financial flexibility, closely monitoring legislative developments, and seeking expert tax advice for informed decision-making.

Conclusion

In conclusion, the reactions of US Business Leaders React to the Proposed Corporate Tax Changes: A Comprehensive Analysis are diverse, reflecting the complex implications of these potential reforms. As businesses navigate this evolving landscape, strategic adaptation and proactive engagement will be essential for success.