Addressing Income Inequality in the US: Solutions and Future Approaches

Addressing income inequality in the US requires a multifaceted approach involving policy changes such as progressive taxation, minimum wage increases, affordable education, and healthcare access to create a more equitable distribution of wealth and opportunities.

The widening income inequality gap in the US presents significant economic and social challenges. Exploring how will the US address the growing income inequality gap and what are the potential solutions is crucial for fostering a more equitable and prosperous society. This article delves into these critical questions, examining current trends and proposing actionable strategies.

Understanding the Income Inequality Gap in the US

Income inequality in the United States has been a persistent and growing issue, impacting various aspects of society. Understanding the roots and consequences of this disparity is essential for developing effective solutions. This section provides an overview of the factors contributing to the widening gap and its far-reaching effects.

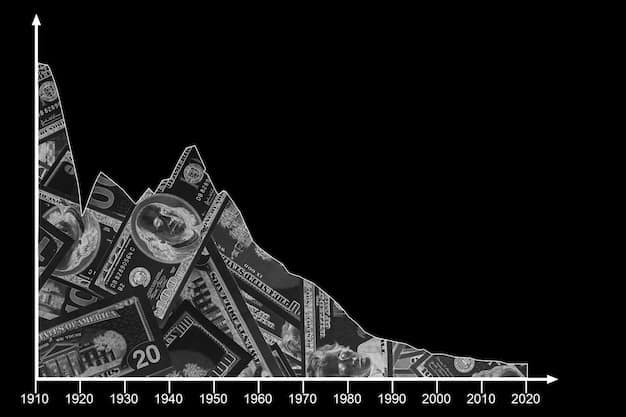

Historical Trends of Income Inequality

Over the past few decades, the gap between the rich and the poor has steadily increased. Factors such as globalization, technological advancements, and changes in tax policies have played significant roles in this trend.

- Globalization: Increased global trade has led to lower wages for some US workers as companies seek cheaper labor overseas.

- Technological Advancements: Automation and the rise of the digital economy have created a demand for highly skilled workers, leaving those with fewer skills behind.

- Tax Policies: Changes in tax laws, such as lower tax rates for the wealthy, have exacerbated income disparities.

Understanding these historical trends helps to contextualize the current state of income inequality and inform potential policy interventions.

Impact on Social Mobility and Economic Growth

The income inequality gap affects not only individuals but also the broader economy. Reduced social mobility and constrained economic growth are among the key consequences.

Limited social mobility means that individuals born into lower-income families have fewer opportunities to climb the economic ladder. This perpetuates inequality across generations. Income inequality can also dampen economic growth by reducing consumer spending and overall demand, as a larger portion of wealth is concentrated in the hands of a few.

In conclusion, understanding the dynamics of income inequality is crucial for devising effective strategies to promote a more equitable and prosperous society.

The Role of Education and Skills Development

Education and skills development play a pivotal role in mitigating how will the US address the growing income inequality gap and what are the potential solutions. By providing individuals with the tools they need to succeed in a changing economy, we can help bridge the income gap and promote greater economic mobility. This section explores the importance of education and skills training in addressing income inequality.

Investing in Early Childhood Education

Early childhood education has a lasting impact on a child’s future success. Providing access to high-quality preschool programs can help children from low-income families develop the skills and knowledge they need to succeed in school and beyond.

Studies have shown that children who participate in early childhood education programs are more likely to graduate from high school, attend college, and secure stable employment. Investing in early childhood education is a cost-effective way to address income inequality and promote long-term economic growth.

Promoting Vocational Training and Lifelong Learning

In addition to traditional education, vocational training and lifelong learning opportunities are essential for equipping individuals with the skills they need to thrive in a rapidly evolving job market.

- Apprenticeships: Programs that combine on-the-job training with classroom instruction can provide individuals with valuable skills and experience.

- Community Colleges: These institutions offer affordable education and training programs tailored to the needs of local employers.

- Online Learning: Online courses and resources can provide individuals with flexible and accessible learning opportunities.

By investing in vocational training and lifelong learning, we can help individuals adapt to changing job demands and increase their earning potential.

In conclusion, ensuring access to quality education and skills development is crucial for reducing income inequality and creating a more equitable society. By investing in early childhood education and promoting vocational training, we can equip individuals with the tools they need to succeed in the modern economy.

Tax Policies and Income Redistribution

Tax policies and income redistribution are key mechanisms that governments use to address income inequality. Progressive taxation, where higher earners pay a larger percentage of their income in taxes, can generate revenue for social programs and reduce the income gap. This section examines various tax policy options and their potential impact.

Progressive Taxation: A Tool for Equity

Progressive taxation is designed to redistribute wealth by taxing higher incomes at higher rates. The revenue generated can then be used to fund social programs, such as education, healthcare, and affordable housing, which benefit lower-income individuals and families.

Implementing a progressive tax system requires careful consideration of tax rates, deductions, and loopholes to ensure fairness and efficiency. It’s also essential to balance the need for revenue with the potential impact on economic incentives.

Expanding Social Safety Nets

Social safety nets, such as unemployment benefits, food assistance programs, and affordable housing, provide crucial support for individuals and families facing economic hardship. Expanding these programs can help reduce poverty and promote greater income equality.

- Unemployment Benefits: Providing temporary financial assistance to individuals who have lost their jobs can help them meet their basic needs while they search for new employment.

- Food Assistance Programs: Programs like SNAP (Supplemental Nutrition Assistance Program) help low-income families afford nutritious food.

- Affordable Housing: Increasing the availability of affordable housing can reduce housing costs for low-income individuals and families, freeing up resources for other essential needs.

By strengthening social safety nets, we can help ensure that all individuals have access to basic necessities and opportunities to improve their economic standing.

In conclusion, tax policies and income redistribution play a vital role in addressing income inequality. By implementing progressive taxation and expanding social safety nets, we can create a more equitable and just society.

The Role of Minimum Wage and Labor Market Policies

Minimum wage and labor market policies are critical components in addressing income inequality. Raising the minimum wage can directly improve the earnings of low-wage workers, while policies that protect workers’ rights and promote fair labor practices can create a more equitable labor market. This section explores the potential impact of these policies.

Raising the Minimum Wage: Pros and Cons

Increasing the minimum wage is a direct way to boost the incomes of low-wage workers. Proponents argue that it can reduce poverty, stimulate economic growth, and improve worker morale. However, opponents worry that it could lead to job losses and increased prices.

Research on the effects of minimum wage increases has yielded mixed results. Some studies have found little to no impact on employment, while others have found that it can lead to job losses in certain industries. The impact of minimum wage increases likely depends on various factors, such as the size of the increase and the local economic conditions.

Strengthening Labor Unions and Workers’ Rights

Labor unions play a crucial role in advocating for workers’ rights and promoting fair labor practices. Stronger unions can help ensure that workers receive fair wages, benefits, and working conditions. Policies that protect workers’ rights, such as the right to organize and bargain collectively, can create a more equitable labor market.

- Collective Bargaining: Allowing workers to bargain collectively can help them negotiate better wages and benefits.

- Protecting Workers’ Rights: Laws that protect workers from discrimination, harassment, and unsafe working conditions can help create a more equitable workplace.

By strengthening labor unions and protecting workers’ rights, we can help ensure that all workers are treated fairly and have the opportunity to earn a decent living.

In conclusion, minimum wage and labor market policies can play a significant role in addressing income inequality. By raising the minimum wage and strengthening labor unions, we can create a more equitable labor market and improve the economic well-being of low-wage workers.

Healthcare Access and Affordability

Healthcare access and affordability are critical factors influencing income inequality. The high cost of healthcare can create a significant financial burden for low-income individuals and families, limiting their opportunities for economic advancement. This section examines the challenges of healthcare access and affordability and potential solutions.

Expanding Access to Affordable Healthcare

Ensuring that all individuals have access to affordable healthcare is essential for promoting greater economic equality. Policies that expand access to healthcare, such as the Affordable Care Act (ACA), can help reduce the financial burden on low-income individuals and families.

Medicaid expansion, subsidies for health insurance premiums, and investments in community health centers can all help expand access to affordable healthcare. By reducing the financial barriers to healthcare, we can help ensure that all individuals have the opportunity to lead healthy and productive lives.

Addressing the High Cost of Healthcare

In addition to expanding access to healthcare, it’s also essential to address the high cost of healthcare services. The rising cost of prescription drugs, hospital care, and other medical services can create a significant financial strain on individuals and families.

- Negotiating Drug Prices: Allowing the government to negotiate drug prices can help reduce the cost of prescription drugs.

- Promoting Price Transparency: Requiring hospitals and other healthcare providers to disclose their prices can help consumers make informed decisions about their healthcare.

Addressing the high cost of healthcare is essential for promoting greater economic equality and ensuring that all individuals have access to the care they need.

In conclusion, healthcare access and affordability are critical factors influencing income inequality. By expanding access to affordable healthcare and addressing the high coast of healthcare services, we can create a more equitable and just society.

The Impact of Housing Policies

Housing policies significantly impact income inequality by affecting affordability, access to opportunities, and wealth accumulation. Addressing housing disparities can help bridge the income gap and promote greater economic mobility. This section explores how housing policies contribute to inequality and potential solutions.

Affordable Housing Initiatives

The lack of affordable housing disproportionately affects low-income individuals and families, limiting their ability to save money, access better education, and live in safe neighborhoods. Initiatives such as rent control, housing vouchers, and increased investment in public housing can alleviate these burdens.

Rent control policies can stabilize housing costs for tenants, while housing vouchers provide financial assistance to help low-income families afford private market housing. Increased investment in public housing can expand the supply of affordable housing options.

Zoning and Land Use Reform

Zoning laws that restrict the development of affordable housing in certain areas can exacerbate income inequality by limiting access to high-opportunity neighborhoods. Reforming zoning and land use policies can promote greater housing diversity and integration.

- Inclusionary Zoning: Requiring developers to include a certain percentage of affordable units in new developments.

- Density Bonuses: Allowing developers to build more units in exchange for including affordable housing.

By reforming zoning and land use policies, we can help create more inclusive communities and expand access to opportunities for all.

In conclusion, housing policies play a crucial role in addressing income inequality. By implementing affordable housing initiatives and reforming zoning laws, we can help create more equitable communities and promote greater economic mobility.

| Key Point | Brief Description |

|---|---|

| 📊 Progressive Taxation | Taxing higher earners at higher rates to fund social programs. |

| 📚 Education Investment | Enhancing early childhood education and vocational training. |

| 💰 Minimum Wage | Increasing the minimum wage to support low-wage workers. |

| 🏥 Healthcare Access | Expanding affordable healthcare options for all citizens. |

Frequently Asked Questions (FAQ)

▼

Key drivers include globalization, technological advancements, changes in tax policies favoring the wealthy, and declining union membership.

▼

Education provides individuals with skills needed for higher-paying jobs, fostering economic mobility and reducing the gap between high and low earners.

▼

Progressive tax systems can redistribute wealth by taxing higher incomes at higher rates, funding social programs that benefit lower-income individuals.

▼

Affordable healthcare reduces financial burdens on low-income families, enabling them to save and invest in their future rather than struggling with medical debt.

▼

Accessible housing reduces financial strain, freeing up resources for education, healthcare, and other essential investments, promoting long-term economic stability.

Conclusion

Addressing income inequality in the US requires a comprehensive strategy that includes education, fair labor practices, progressive tax policies, and affordable healthcare. By implementing these measures, the US can strive towards a more equitable and prosperous society for all its citizens.